net investment income tax brackets 2021

If your Modified Adjusted Gross Income exceeds 200000 or 250000 if youre married and filing jointly you may be subject to the NIIT. 1 Net Investment Income or 2 MAGI in excess of 200000 for single filers or head of households 250000 for married couples filing jointly and 125000 for married couples filing separately.

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Lets say you have 30000 in net investment income and your MAGI goes over the threshold by 50000.

. Married filing jointly 250000 Married filing separately 125000 Single or head of household 200000 or. Interest dividends capital gains rental and royalty income and non-qualified annuities. Overview Data and Policy Options Since 2013 certain higher-income individuals have been subject to a 38 unearned income Medicare contribution tax more commonly referred to as the net investment income tax NIIT.

Over 19900. Investment Income NOT Investment Income Taxable income from items that are NOT investment income can push taxpayers over the income threshold and cause investment income to be subject to the 38 surtax. 2021 Federal Income Tax Brackets.

The threshold for trusts and estates is the amount at which the top trust tax. That means you could pay up to 37 income tax depending on your federal income tax bracket. In general net investment income includes but is not limited to.

10 of income over 0. Below are the tax rates and income brackets that would apply to estates and trusts that were opened for deaths that occurred in 2021. The net investment income tax NIIT is a 38 tax on investment income such as capital gains dividends and rental property income.

9950 or less 12. Rate Married Joint Return Single Individual Head of Household Married Separate Return. All About the Net Investment Income Tax.

Trusts are hit hard The 38 surtax kicks in at much lower income levels for trusts. Your 2021 Tax Bracket to See Whats Been Adjusted. Sunday April 17 2022.

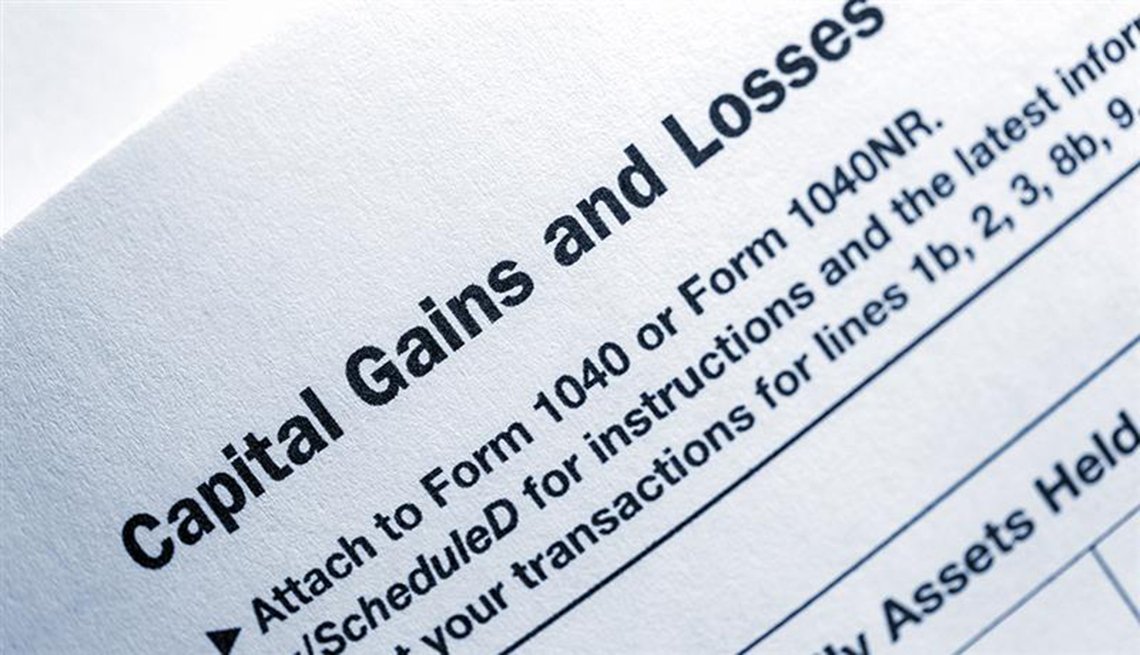

In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year. Discover Helpful Information and Resources on Taxes From AARP. Some interest income is tax-exempt though.

The Net Investment Income Tax shouldnt be an everyday or every year thing it applies to investment income above a fairly large threshold. Your net investment income is less than your MAGI overage. They would apply to the tax return filed in 2022.

Ad Compare Your 2022 Tax Bracket vs. 99950 199900 28 tax rate applies to income over. It only applies to incomes.

Tax status NIIT Threshold Married Filing Jointly 250000 Head of Household 200000 Single 200000 Married Filing Separately 125000. For estates and trusts the 2021 threshold is 13050 Definition of Net Investment Income and Modified Adjusted Gross Income. 2021 Tax Brackets for Single Filers Married Couples Filing Jointly and Heads of Households.

2021 Tax Brackets. But not everyone who makes income from their investments is impacted. In general net investment income for purpose of this tax includes but isnt limited to.

Capital gains tax rates on most assets held for a year or less correspond to. 265 24 of income over 2650. Net investment income tax brackets 2021.

26 tax rate applies to income at or below. A married couple with a net investment income of 240000 and modified adjusted gross income of 350000 will pay 38 on the lesser amount of the 240000 of net investment income or 350000 250000 100000 of modified adjusted gross income yielding an NIIT of 100000 3 8 3800. But not everyone who makes income from their investments is impacted.

The statutory authority for the tax is. The tax applies to passive investment income only which includes. Net Investment Income Tax NIIT is a 38 same tax rate tax year 2021 2020 of Medicare tax that applies to investment income and to regular income over a certain threshold.

Youll owe the 38 tax. The net investment income tax is a 38 surtax that is paid in addition to regular income taxes. To see what rate youll pay see What Are the Income Tax Brackets for 2021 vs.

Surtax on Net Investment Income Theres an additional 38 surtax on net investment income NII that you might. But youll only owe it on the 30000 of investment income you havesince its less than your MAGI overage. Tax Rate For Single Filers Taxable Income For Married Individuals Filing Joint Returns Taxable Income For Heads of Households Taxable Income.

2020-2021 Capital gains tax brackets. Those rates range from 10 to 37 based on the current 2021 tax brackets. In the US short-term capital gains are taxed as ordinary income.

Interest dividends certain annuities royalties and rents unless derived in a trade or business in which the NIIT doesnt apply income derived in a. More specifically this applies to the lesser of your net investment income or the amount by which your modified adjusted gross income MAGI surpasses the filing status-based thresholds the IRS. The net investment income tax or NIIT is an IRS tax related to the net investment income of certain individuals estates and trusts.

This tax only applies to high-income taxpayers such as single filers who make more than 200000 and married couples who make more than 250000 as well as certain estates and trusts. April 28 2021 The 38 Net Investment Income Tax. What is the Net Investment Income Tax Rate.

1 Net Investment Income or 2 MAGI in excess of 200000 for single filers or head of households 250000 for married couples filing jointly and 125000 for married couples filing separately. 38 tax on the lesser of. Qualifying widow er with a child 250000.

Your additional tax would be 1140 038 x 30000. Not all income is taxed according to the marginal tax brackets and capital gains income from when you sell an investment or asset for a profit are the big.

How To Calculate Capital Gains And Losses

Income Tax Brackets For 2022 Are Set

How Do State And Local Individual Income Taxes Work Tax Policy Center

Dividend Tax Rates In 2021 And 2022 The Motley Fool

Income Tax Brackets For 2022 Are Set

Tax Brackets For 2021 2022 Federal Income Tax Rates

Iowans Here S Your 2021 And 2022 Iowa Income Tax Brackets And Planning Opportunities To Know About Arnold Mote Wealth Management

What S In Biden S Capital Gains Tax Plan Smartasset

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

The 2022 Capital Gains Tax Rate Thresholds Are Out What Rate Will You Pay

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Irs Tax Brackets 2022 What Are The Capital Gains Tax Rate Thresholds Marca

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Capital Gains And Dividend Tax Rates For 2021 2022 Wsj

What Is The The Net Investment Income Tax Niit Forbes Advisor

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)